Five years ago, data centers were designed to store files and run everyday software. Today, they are being reimagined from the ground up to function as AI super-factories, running advanced AI workloads round the clock. This transformation is not subtle, but rather a structural shift in how these giant computing hubs are designed, where they are built, and what power sources power them.

One of the key drivers of this shift is the rapid commercialization of AI we’ve seen over the past three years. Platforms like ChatGPT have grown in a short period of time to attract nearly a billion monthly users, rivaling top internet platforms in scale.1 New AI products are launching every day, while query volume is scaling at an unprecedented pace. Across customer service, medical diagnostics, logistics, and fraud detection, AI applications are surging into production, limited only by the availability of AI-tuned computing infrastructure.

To support the surge in AI computing needs and to enable frontier tech like Physical AI or Quantum Computing, global data center capacity needs to expand significantly. In our view, a generational buildout targeting the rails of the AI economy is currently unfolding, which could present a compelling thematic opportunity for investors seeking defensive exposure to the AI theme.

And in our view, the Global X Data Center & Digital Infrastructure ETF (DTCR) provides a targeted approach to this opportunity, as it seeks to capture companies driving the scale-out of AI infrastructure and the next wave of data center operations.

Key Takeaways

- Data centers are adapting from simply storing files and running software to hubs that produce and operate AI.

- Data center supply remains tight, pricing power is rising, and new investments - backed by multi-year leases - are growing.

- DTCR provides targeted exposure to the digital infrastructure ecosystem, which could be a defensive way to gain exposure to the multi-decade AI paradigm shift.

Data Centers Are the New AI Toll Booths

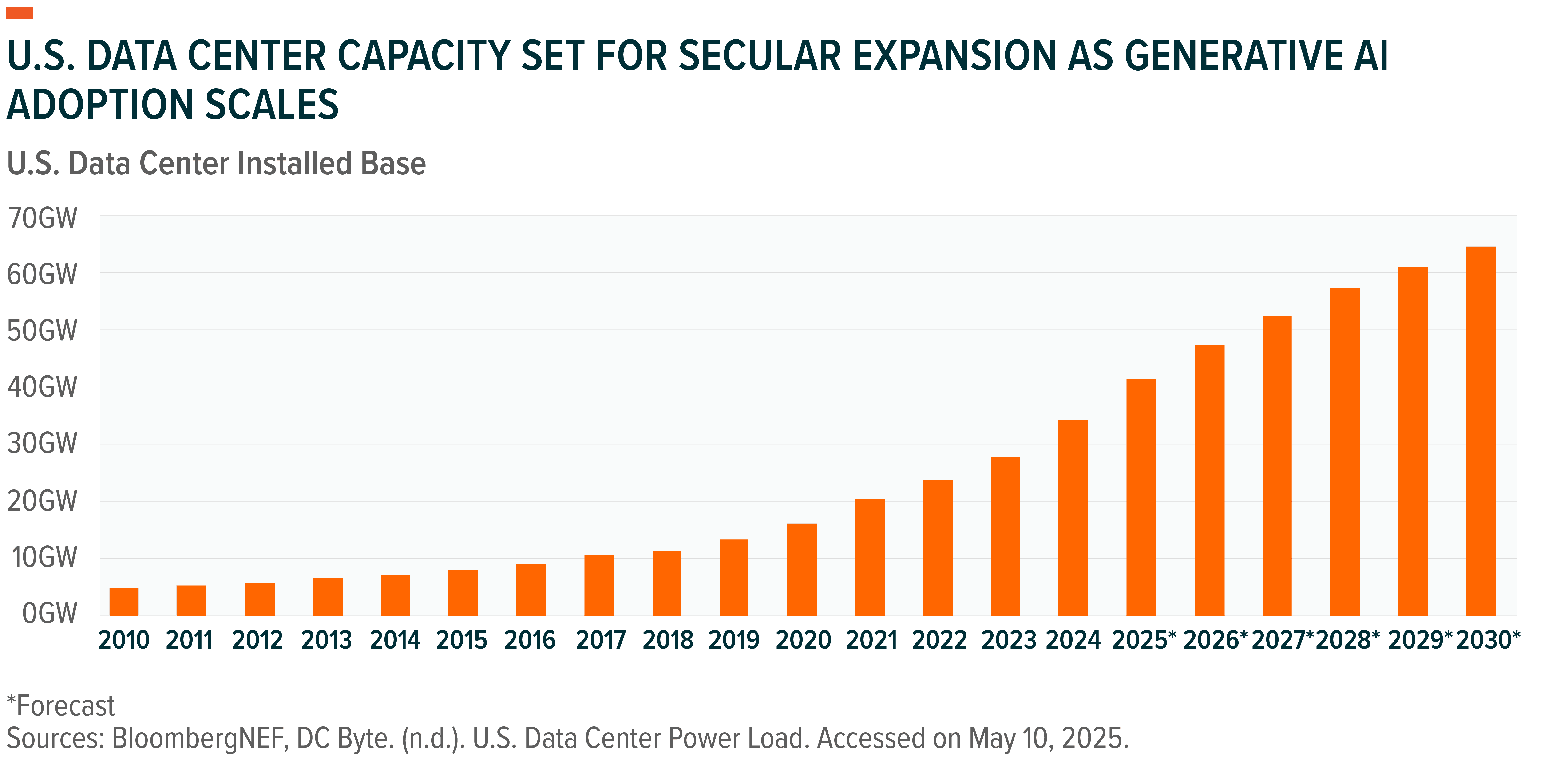

Over the past decade, data centers were primarily built to handle the surge in data creation and software adoption. Between 2015 and 2025, global data assets surged by 1,258%.2 Global software spending is forecasted to nearly quadruple.3 Consumers - empowered by 5G, better mobile devices, and the mass digitization of daily life during the pandemic - were the primary drivers of this buildout. Mobile games, streaming, chat apps, payment apps, and such compounded the trend.

That dynamic shifted dramatically with the arrival of ChatGPT. Conversational AI became the mass market interface almost overnight, spiking user engagement and pushing large language models to process more data, faster. At the same time, users' expectations grew, with queries accompanied by images, videos, and longer context windows, further compounding computing demands and triggering a wave of new AI applications. All of this has resulted in unprecedented processing capacity demand that the AI industry hadn’t fully anticipated.

The industry has responded by investing aggressively and urgently. Globally $455 billion was spent on data centers in 2024, up 51% year-over-year YoY.4 And yet, the true scale of power-hungry, latency-sensitive AI compute is only beginning to reveal itself as applications remain tightly metered and the availability of AI servers, especially with sufficient power connectivity, continues to be a critical bottleneck.5 In our view, this buildout of AI processing’s backbone has only begun and will shape the data center industry over the next few years.

And from a user-demand perspective, we’ve just scratched the surface of the opportunity. Only 34% of U.S. adults claim to be users of ChatGPT.6 Beyond that, most users will probably experience conversational AI weightlessly without logging into apps like ChatGPT, as AI it gets integrated into social media platforms, digital maps, productivity software, and smartphones. This seamless integration is further compounding the demand for specialized data center processing. New paradigms like Agentic AI or Physical AI remain majorly constrained by the availability of computing infrastructure today.

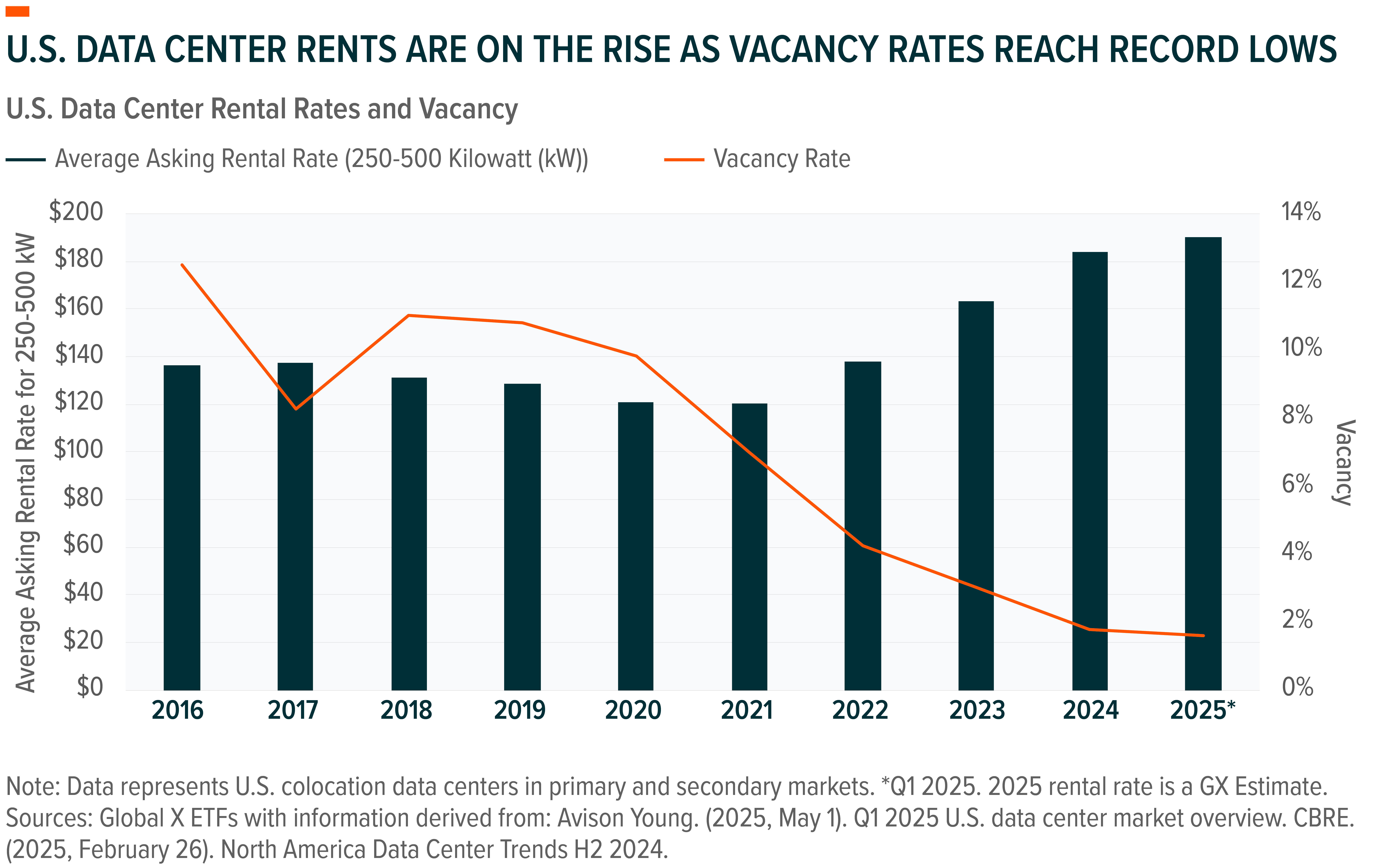

Scarcity Drives Pricing Power in AI-Era Data Centers

As demand for AI compute surges, U.S. data center capacity is reaching critical limits. Across major U.S. data center markets, vacancy rates are at historic lows. In Q1 2025, vacancy stood at just 1.6%, with key hubs like Northern Virginia operating even tighter.7 This trend persists even amid record breaking new construction activity in 2024, which saw nearly 7 GW of new capacity brought to market, twice that of the year prior.8 For context, new data center absorption grew 34% YoY in 2024, after a 26% growth in 2023. Given the typical 12-18-month data center development timeline, this imbalance is expected to continue well into 2026.

Scarcity of capacity creates powerful tailwinds for incumbent operators. With few alternatives available at the scale and size that AI adopters require, customers are less inclined to switch suppliers, keeping churn low and occupancy high. That gives data center operators the upper hand when negotiating contract renewals, often locking in higher rents with minimal pushback. Rental rates had already surged to all-time highs by the end of 2024.9 Rising yields, which indicate stronger pricing relative to development costs, further enhance the advantage of scale, which larger operators can translate into better financing terms.

Moreover, leading data center operators typically structure multi-year leases with hyperscalers and large enterprises, often spanning 10 to 15 years.10 These agreements support predictable earnings, particularly as clients become deeply embedded within specific facility ecosystems. This stickiness reinforces the defensive growth profile of data centers.

Data Center Operators Race to Bring AI Projects to Market

As customer pipelines for AI capacity grows, major colocation data center operators are racing to scale and bring new capacity online.

- Equinix: Equinix is a leading U.S. based co-location data center provider. Earlier this year during its Q1 2025 earnings, Equinix highlighted an aggressive expansion to grow its global data center footprint. The company is currently advancing 56 projects, across 24 countries, including 12 x-Scale projects, which are Equinix’s Hyperscale data center facilities.11

- Digital Realty: Another major U.S. data center wholesaler - serving clients such as IBM, Oracle, and Meta Platforms - has experienced strong earnings and revenue growth from existing capacity and is actively scaling to meet rising demand.12 The company is currently developing approximately 499 MW of new capacity across the Americas, with major projects concentrated in Northern Virginia, Chicago, and Dallas.13

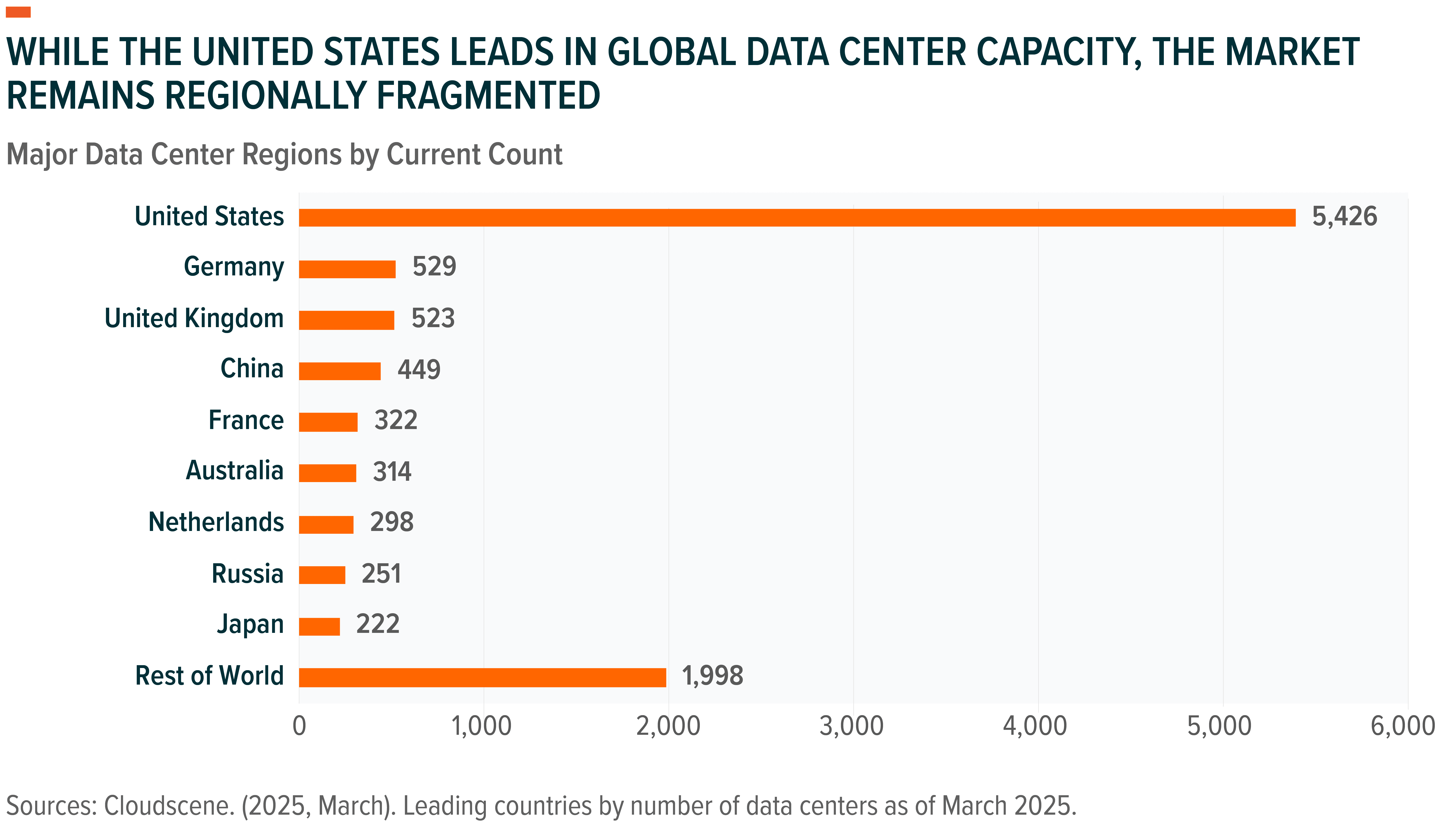

AI Is No Longer Just a U.S. Story, It Is Going Global

While the U.S. continues to lead in AI innovation - thanks in part to its dominance in semiconductors through companies like Nvidia - the data center infrastructure story is rapidly globalizing.

In China, open-source models like DeepSeek have unlocked rapid deployment of AI at scale. As enterprise and consumer use cases expand, infrastructure demands are expected to grow in parallel. Power consumption from Chinese data centers alone is expected to triple by 2030 to nearly 600 TWh, nearly twice that of the entire country of Indonesia.14 Chinese data center players like VNET Group have seen fundamentals accelerate. For example, VNET’s Q1 revenues grew 11.4% YoY, with a 35% quarter-over-quarter (QoQ) surge in wholesale capacity as domestic tech giants scale out AI services. The availability of Nvidia hardware locally, starting July 2025, is likely to further catalyze this trend.15

Regions like Europe are also accelerating their AI infrastructure buildouts. Analysts expect the EU to absorb a record 937 MW of capacity in 2025, up 43% YoY, driven by sovereign AI efforts and regional digitization strategies.16 Similar trends can be noted across other key regions, racing to bring new AI-data center capacity online.17 Both Equinix and Digital Realty, two of the largest independent data center operators worldwide, have scored many of their new deals in international markets this year. 18,19

Worldwide, data center power demand is expected to grow to 945 TWh by the end of this decade, more than doubling from the total consumption at the end of 2024.20 Majority of this expansion is yet to be built. For investors, this potential and global dispersion reinforces the opportunity for exposure beyond just U.S. hyperscalers.

DTCR: Targeting the Long Tail of Digital Infrastructure Buildout

The Global X Data Center & Digital Infrastructure ETF (DTCR) is designed to provide targeted exposure to the companies powering the backbone of AI and next-generation computing. The fund seeks to track the Solactive Data Center REITs & Digital Infrastructure Index, which emphasizes depth, global reach, and thematic purity:

- Targeted Value Chain: DTCR captures companies across the full data center and digital infrastructure stack, including developers and operators of data centers, developers and operators of cellular towers, and companies that manufacture the servers and hardware used in these facilities.

- Global Exposure: DTCR inherently takes a global approach to capturing companies, which ensures that the fund offers exposure to key data center markets like China, South Korea, as these regions are increasingly key to the tech industry and AI’s advancement.

- Modified Market Cap Weighting: With a modified market-cap weighted methodology, DTCR allows leading players to grow in influence in the fund. The fund’s index caps Data Center or Cellular Tower holdings at 12%, with an even stricter 2% cap applied to Server and/or Hardware companies.

Additionally, the index ensures high thematic purity by requiring constituents to generate at least 50% of their revenue from the Data Center or Cellular Tower-related sub-themes, which maintains a sharp focus on computing businesses.

Conclusion: We Believe Data Center & Digital Infrastructure Is the Next AI Frontier

Data Centers are becoming the checkpoint where every AI interaction must pass through. In our view, they are the utilities of the AI age. Computing needs are also likely to expand aggressively from everyday conversational AI apps towards Physical AI and high-performance computing, such as those of Quantum Computing. Data center operators who can bring capacity online quickly, and monetize it through their existing clientele and distribution, stand to benefit meaningfully.

Related ETFs

DTCR – Global X Data Centers & Digital Infrastructure ETF

AIQ – Global X Artificial Intelligence & Technology ETF

Click the fund name above to view current performance and holdings. Holdings are subject to change. Current and future holdings are subject to risk.