This piece is one in a series that delves further into the leading themes emerging from this year’s iteration of our flagship research project, Charting Disruption.

The once-theoretical idea of artificial general intelligence (AGI) – loosely defined as tech that can think, reason, and act like humans – is rapidly coming into focus. Progress in large language models (LLMs) and the expansion of advanced AI data centers are driving machines closer to human-level intelligence, lowering compute costs, and broadening applications. This shift is beginning to automate routine work and boost productivity, dividing the economy between AI adopters and everybody else.

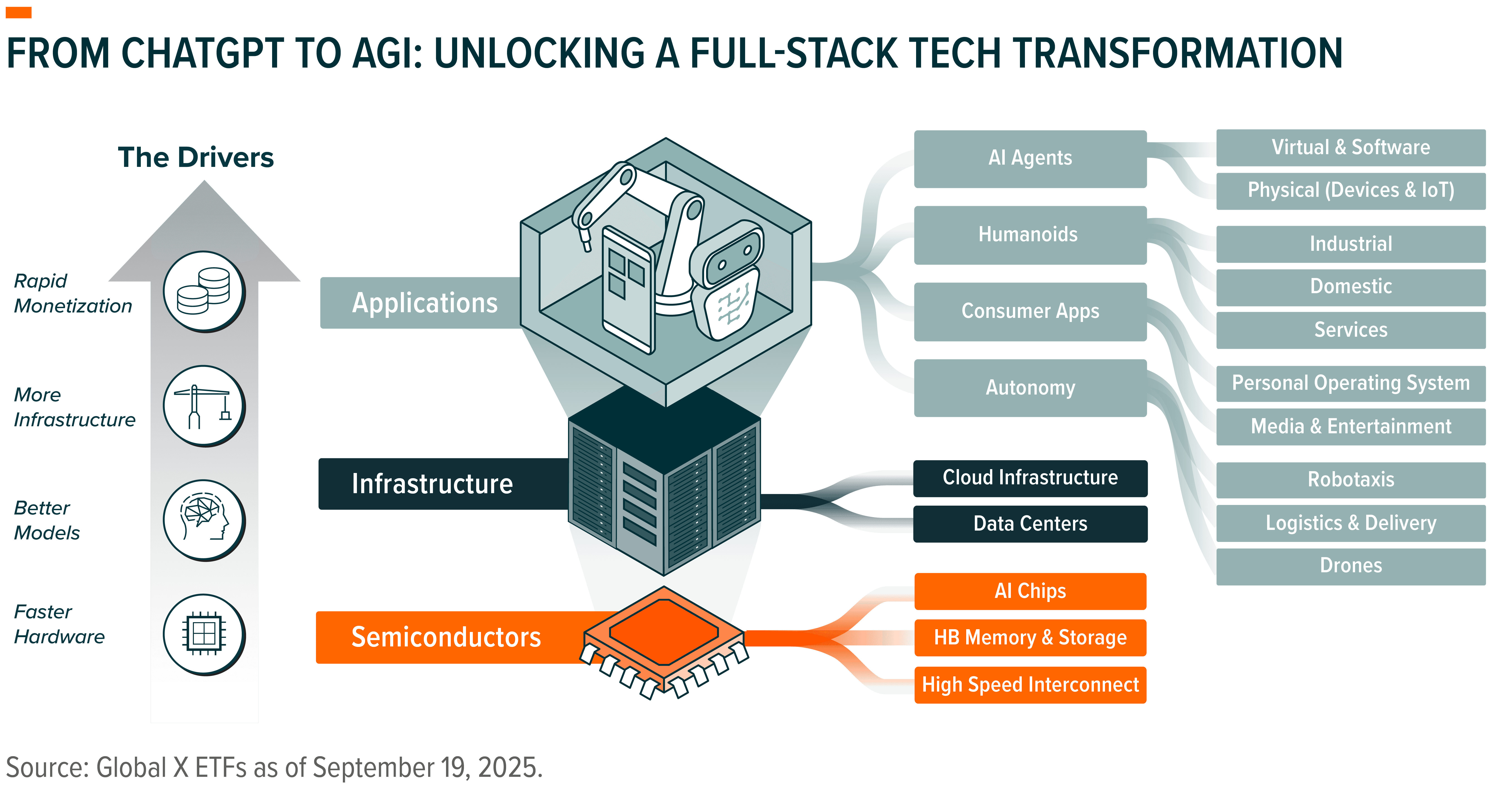

Achieving AGI will likely require trillions of dollars in investments across graphic processing units (GPUs), data centers, and power systems.1 As this infrastructure scales, it will enable more capable models, accelerate the creation of AI agents and applications, and reshape the technology stack from semiconductors to software. For investors, exposure along the path to AGI, through AI semiconductors, data center infrastructure, and intelligent apps, is likely essential to capture growth and avoid structural disruption.

Key Takeaways

- Advances in AI models and computing power are bringing human-like intelligence closer than ever.

- A multi-trillion-dollar buildout in GPUs, data centers, and power systems will likely drive the next AI wave.2

- Companies enabling or leveraging this infrastructure stand to benefit most from the coming disruption.

The Multi-Trillion-Dollar AI Supercycle Is Accelerating

AI has existed for decades, but its use was mostly confined to well-resourced organizations. That changed with the launch of ChatGPT, which made advanced AI accessible to anyone with an internet connection. In a matter of months, AI went from a specialized research tool to a mainstream utility – catalyzing the transition from the Information Age to the Intelligence Age. We are now entering an era where machines can learn, reason, and act, unlocking new levels of productivity for both consumers and businesses.

Two dynamics make this AI supercycle fundamentally different from past technology booms. First, generative AI requires no new hardware for consumers to participate. It scales through existing devices and networks, ensuring pent-up demand for AI compute. Second, AI’s applicability is broad. Cutting across every major sector – from manufacturing to finance to healthcare to cybersecurity – AI embeds intelligence wherever data exists, which accelerates adoption curves and magnifies its economic impact.

Technology earnings have compounded more than three times faster than the S&P 500 over the last two decades.3 Generative AI and eventually AGI could amplify that trend, fueling a new wave of productivity and profit growth for value chain enablers and leading AI platforms. In our view, the transformation could unfold in three reinforcing waves. First, smarter reasoning models that generalize across tasks. Second, agentic systems that string steps together, interact with each other, and close decision loops. Third, multimodal systems that fuse text, vision, audio, and code, expanding AI’s influence on the real world through physical AI.

This innovation depends on scaling compute, data centers, and power infrastructure, which is likely to require trillions of dollars in new investment and could redefine every layer of the modern computing stack.

AI Remains Bottlenecked by Semiconductors, Data Centers, and Power

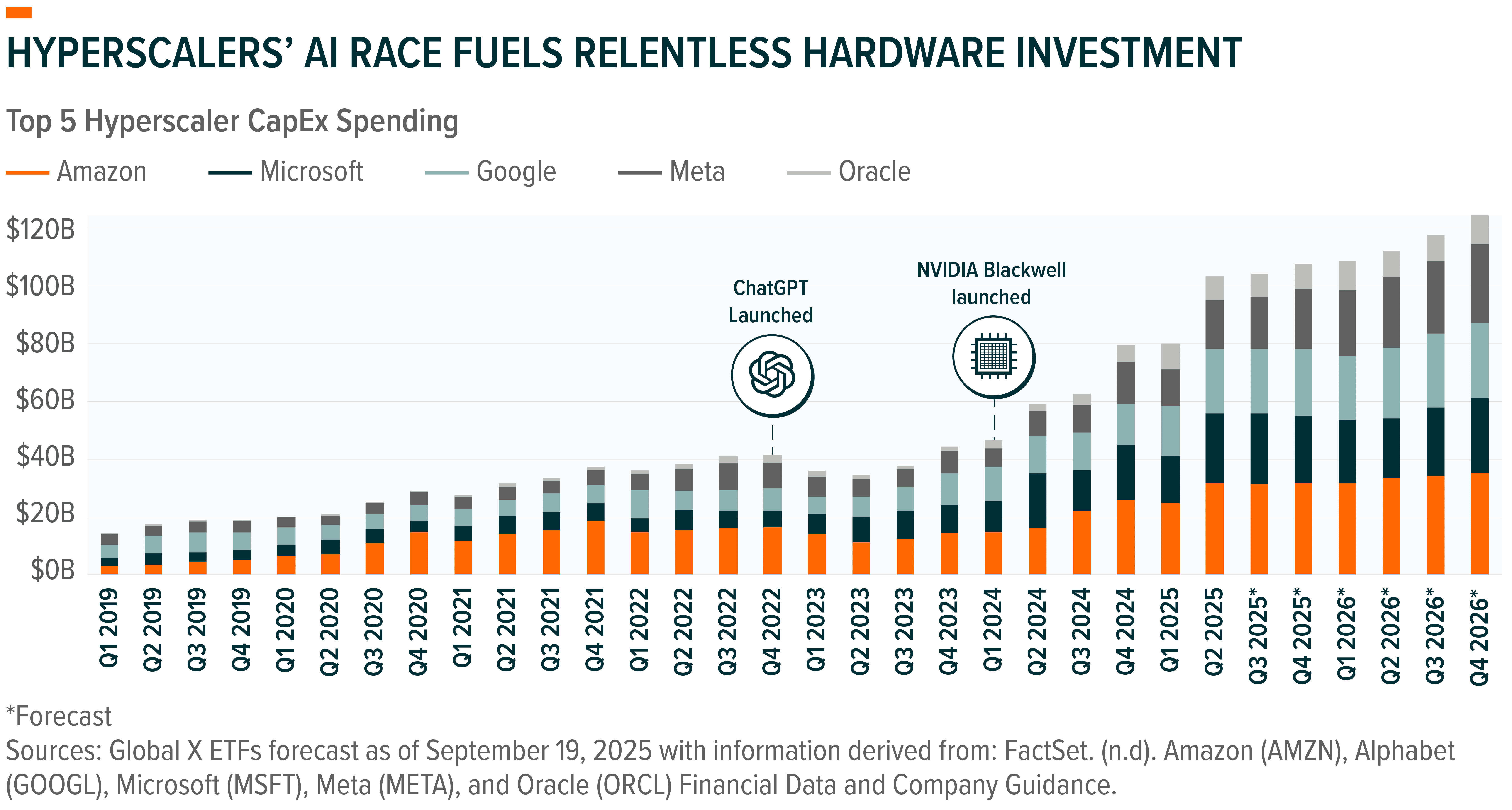

AI may not require new consumer hardware today, but it does depend on massive, centralized computing hubs made up of thousands of chips. Integrated with memory, storage, and power systems, these hubs collectively constitute the backbone of intelligence. This infrastructure processes every query and application that embeds AI, and as adoption accelerates, demand for compute is outpacing supply, forcing hyperscalers to expand this infrastructure at a historic pace.

In 2025, five of the largest hyperscalers – Microsoft, Amazon, Google, Meta Platforms, and Oracle – could collectively spend nearly $400 billion on AI infrastructure, with most of it directed toward AI chips and data centers.4 But capacity cannot be built overnight. The average data center takes roughly 18 months to build.5 Power permits, transformers, and grid interconnects are more gating factors. This dynamic prolongs the buildout cycle while expanding the opportunity set of beneficiaries beyond large cap technology.

One notable beneficiary is the broader semiconductor layer. By 2030, nearly $6.7 trillion could be spent cumulatively on the global AI infrastructure buildout.6 AI processors and computing hardware could attract over $3.1 trillion of that investment.7 That spending is likely to cascade through the ecosystem, boosting memory suppliers, advanced packaging, interconnects, and networking, which must scale in lockstep with processors.

As this buildout unfolds, the scale of these data centers is likely being redefined, primarily driven by their energy needs and the requirements to cool them down. The largest AI supercomputers already dwarf legacy hyperscale facilities, with ambitions to reach clusters of 1million GPUs.8,9 Continuous power, a key input to keep these facilities running, is likely to emerge as a competitive edge, with nations that can supply cheap, reliable energy anchoring the next wave of AI growth. This backdrop boosts power innovation, advancing solutions such as nuclear power, battery storage, and hydrogen fuel cells.

The AI Cost Curve Collapse Fuels the Next Profit Layer

As new data centers are built and algorithms improve, the cost of AI compute is expected to keep falling. This decline will make AI economically viable across a broad range of applications, from software to physical automation systems, over the next few years. The first wave of this expansion is likely to unfold via foundation models embedded into productivity tools, creative suites, cybersecurity systems, and customer service platforms. Each upgrade expands AI’s reach, turning static workflows into adaptive systems that learn from user behavior.

The second wave is likely to be driven by autonomous agents, or AI agents – loosely defined as software systems capable of planning, reasoning, and executing multi-step tasks without human supervision. These agents can chain together tools, interact with other software, databases, and AI systems to deliver outcomes rather than responses. Early examples include customer support bots that handle entire workflows and code-writing agents that iterate autonomously. As their capabilities compound, they will blur the line between software and labor, unlocking new forms of digital productivity and margin expansion across industries.

The final wave is likely to bring intelligence into the real world through physical AI, including robots, drones, and autonomous systems that perform real-world tasks. Falling compute costs and improved multimodal models are accelerating this transition. The same intelligence that currently powers language and image generation is soon likely to drive factory robots, warehouse logistics, and autonomous vehicles. Physical AI should extend AI’s profit pool into the real economy, from cloud servers to the factory floor.

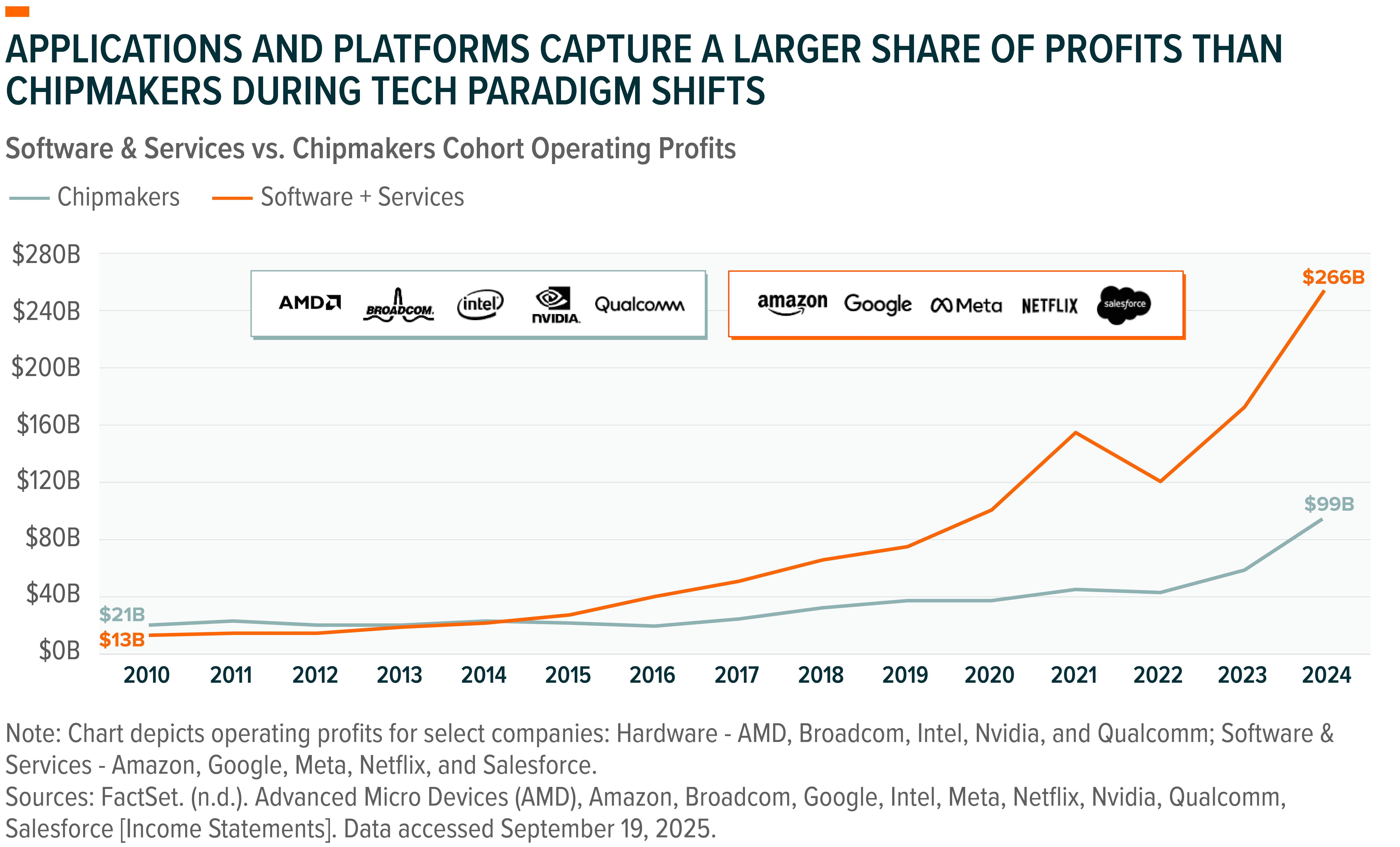

While semiconductors and hardware remain indispensable, the economic gravity could shift as the AI wave unfolds. Previous tech cycles indicate that the application layer ultimately captures most profits once platforms mature.10 Just as smartphones unlocked trillions of dollars in software value above the chip, we believe AI’s long-term profit engine lies in the application and agent ecosystem that monetizes intelligence. This is a critical factor as investors evaluate positioning for the AI supercycle.

Conclusion: The Intelligence Age Has Just Begun

ChatGPT catalyzed the AI phenomenon, and now the buildout of the centralized infrastructure that will run AI is set to be one of the dominant investment themes of the decade. This buildout will likely require trillions of dollars in chips, data centers, and power capacity, and likely cause AI compute costs to fall while expanding capabilities. We expect lower costs to unlock the application layer, creating multiple times the value and profits as AI meets the end user, automates work, and enables new applications. In our view, this generational shift has profound implications for investor portfolios.

For additional insights, please view our full report, Charting Disruption: Outlook for 2026 and Beyond.