This piece is one in a series that delves further into the leading themes emerging from this year’s iteration of our flagship research project, Charting Disruption.

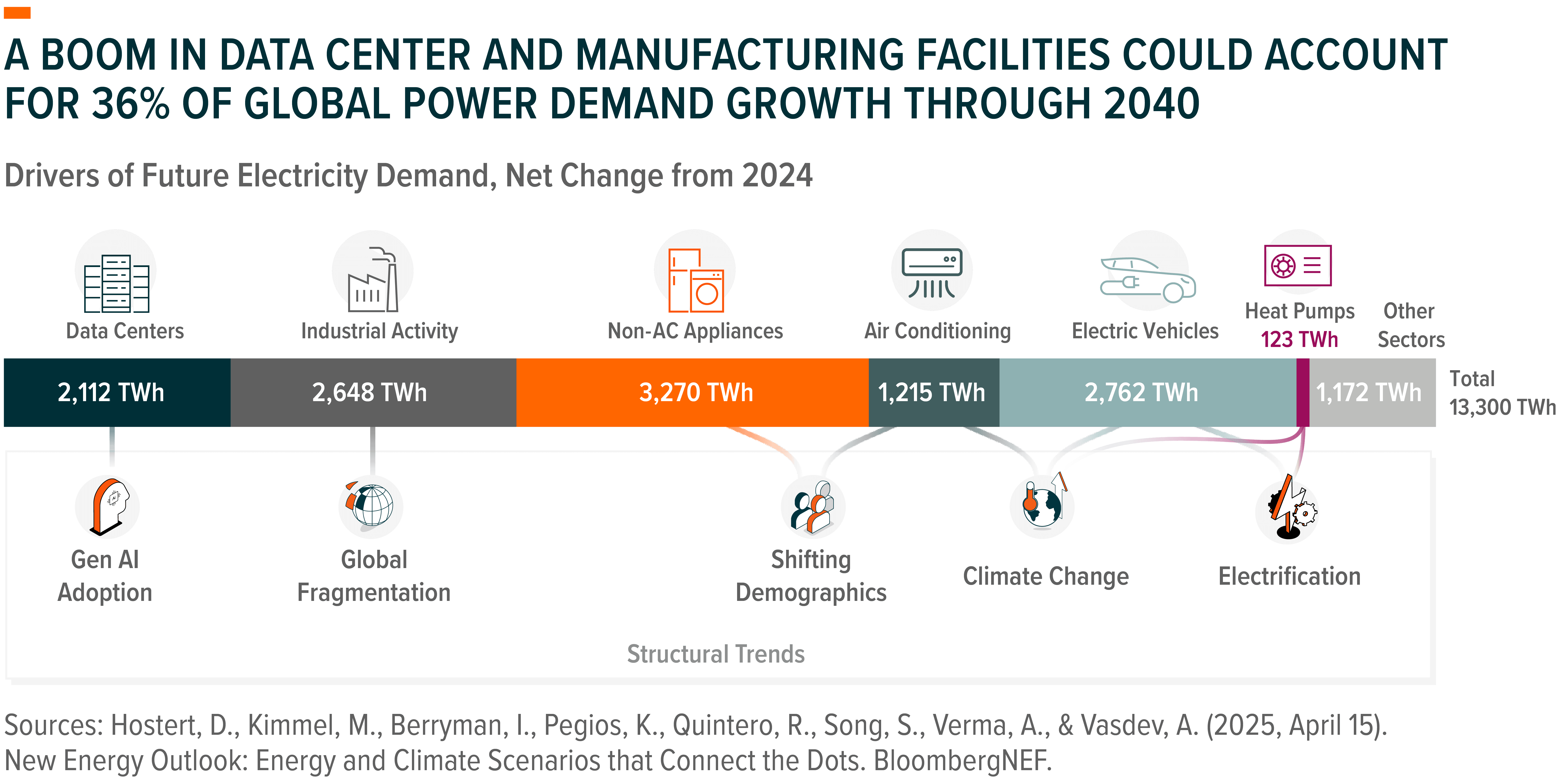

Global electricity demand is forecast to increase by 50% between year-end 2024 and 2040, led by growth in the United States, India, and China.1 The robust outlook stems from multiple structural trends that are likely to lead to higher power consumption across a range of technologies and industries. Surging AI adoption – resulting in the need for power-intensive data centers – is one of the most notable tailwinds to emerge in recent years. Rising global fragmentation, leading to renewed efforts to expand manufacturing capacity outside of China, is expected to boost industrial electricity consumption. Simultaneously, shifting demographics, climate change, and the electrification of transport and heat are driving power demand growth from consumer appliances and electric vehicles. These dynamics could create sizeable opportunities for companies involved in the electricity and grid infrastructure value chain.

Key Takeaways

- Global electricity demand could grow by 13,300 terawatt hours (TWh) through 2040, which is nearly equivalent to the current electricity consumption of China and the United States combined.2

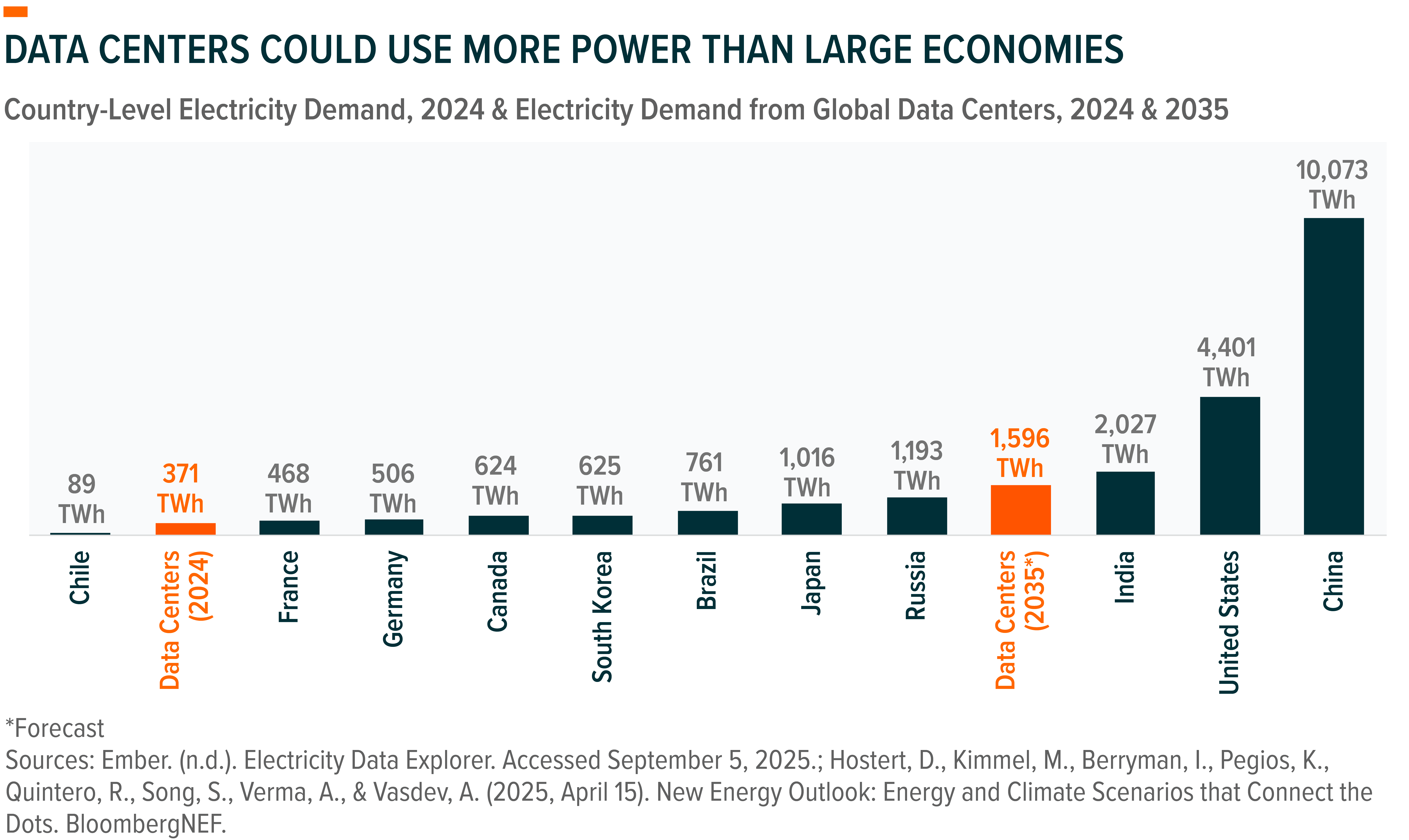

- Data centers are an increasingly significant driver of power demand growth. By 2035, global data center electricity use could rival the power needs of large economies.3,4

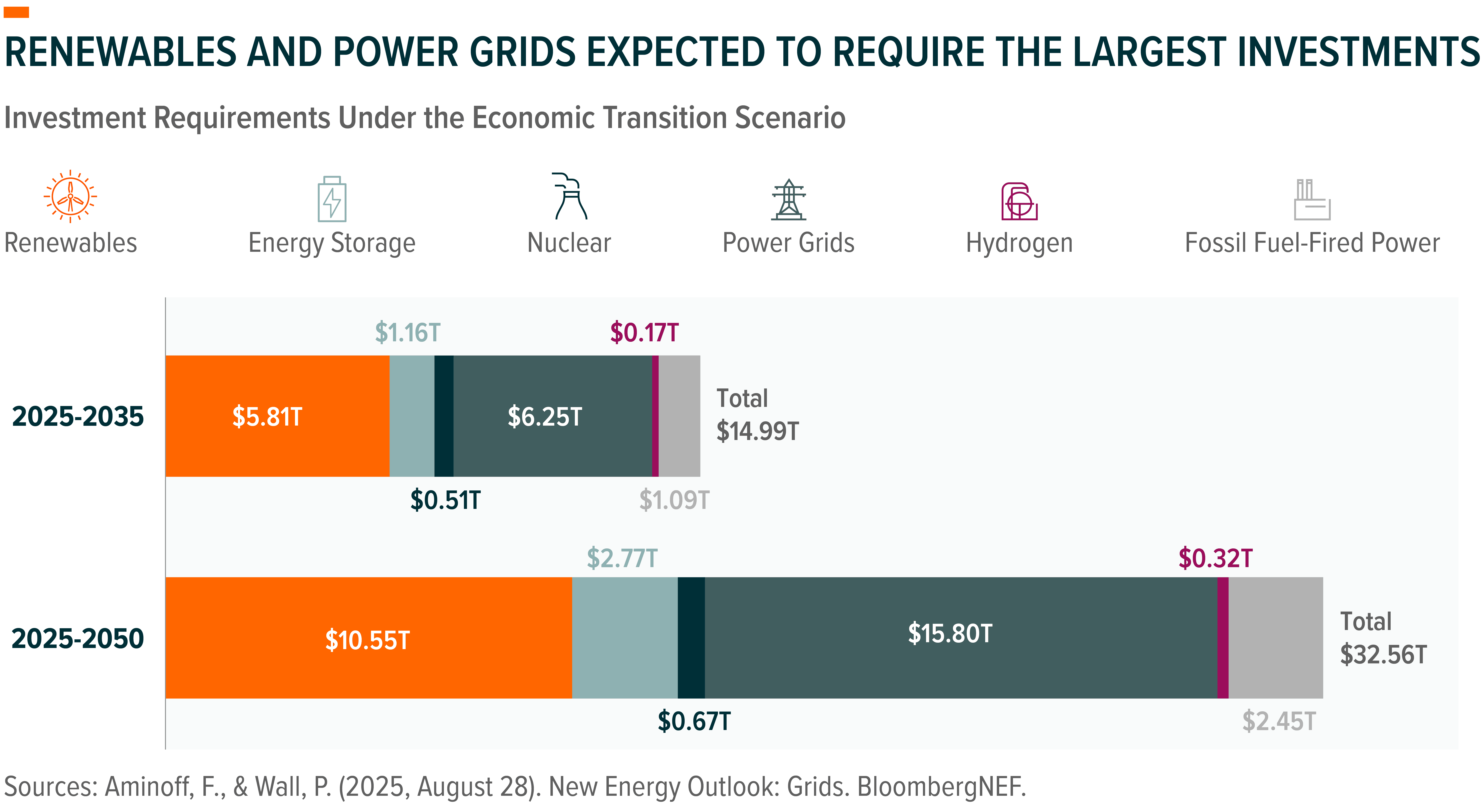

- Many utilities around the world will likely need to expand power generation and grid infrastructure assets, an undertaking that could require $15 trillion in investments through 2035.5

The Power Industry Is Poised for a Dramatic Transformation

Global electricity demand is forecast to skyrocket 50% by 2040.6 This robust outlook largely stems from three key drivers: the ongoing buildout of power-intensive data centers, the electrification of heat and transport, and an anticipated expansion of manufacturing activity in major economies like the United States. At the same time, traditional electricity growth drivers, such as population growth and expanded air conditioning use, are expected to contribute to higher electricity use around the world.

China is expected to remain the largest electricity consumer, with demand forecast to rise from 8,778TWh in 2024 to nearly 14,000TWh by 2040.7 India’s electricity use could more than double from 1,617TWh to 3,474TWh over the same period. Although the United States is forecast to experience the third largest jump, its power market is undergoing a dramatic shift.8 Over the next 15 years, U.S. electricity demand is forecast to increase between 35% and 50%, a substantial reversal from near-flat growth over the past 20 years.9,10

Global Data Center Power Demand Could Grow More Than 4x Between 2024 and 2035

Data centers have emerged as a driving force of rising power demand forecasts around the world. A key reason behind this surge is the growing adoption of generative AI, as large language models often consume large amounts of electricity. For example, a single ChatGPT query can require roughly 10 times the energy of a typical Google search.11

The three major economies driving the AI race are expected to account for the majority of global data center growth. The United States is forecast to remain the leading market, with demand projected to rise from 141TWh in 2024 to nearly 430TWh by 2035.12 China could add just over 300TWh of electricity demand from data centers, while Europe could add nearly 100TWh.13

Globally, data center power demand is forecast to increase from 371TWh in 2024 to 1,596TWh in 2035.14 This level would mean that within a decade, the global data center fleet could require more power than many large economies consumed in 2024, including Brazil, Japan, and Russia.15,16 By 2035, data centers could account for 4.5% of global electricity use, up from a 1.4% share in 2024.17

Modernizing Power Infrastructure Can Create a Multi-Trillion Dollar Opportunity

In many countries, growing electricity needs are compounding at a time when utilities also face mounting security risks from cyberattacks, shifting grid dynamics, and extreme weather. For example, in 2024, Hurricanes Milton and Helene created significant disruptions to power grid infrastructure in the Southeastern United States.

Solving these challenges will likely require trillions of dollars in investments across a variety of power sources, including renewable energy, short- and long-term energy storage, nuclear power, and natural gas. Solar power, wind power, and battery energy storage are forecast to account for a combined 92% of global electricity capacity additions between 2025 and 2040.18 Tech advancements, cost-competitiveness, favorable policies, and corporate power purchases support the robust outlooks for the renewables industry.

The forecasted capacity expansion for nuclear power is smaller, but it is likely to remain a vital solution, particularly for data center operators. Since 2024, the tech sector has emerged as a burgeoning market for traditional and next-gen nuclear power purchase agreements (PPAs).19 In June 2025, for example, Constellation and Meta signed a 20-year PPA for the 1,121-megawatt (MW) Clinton nuclear power plant in Illinois to support Meta’s operations, beginning in 2027.20 Also in June, Amazon and Talen Energy signed a 1,920MW PPA to use the utility’s Susquehanna nuclear power plant in Pennsylvania to power Amazon Web Services’ (AWS) data centers in the region.21 Small modular reactor (SMRs) developers, such as Oklo and NuScale, also signed agreements to supply power to data centers in the future.22,23

In total, nearly $15 trillion in global investments could be required for electricity generation facilities and power grid infrastructure through 2035, with the largest investments expected for renewables and power grids.24 By 2050, total investment needs for power grids are projected to more than double.25

Conclusion: Power Is Pivotal to the Modern Economy

The advancement of disruptive technologies, such as AI and electric vehicles, requires an unprecedented power capacity expansion. Meeting future power needs likely calls for large-scale deployment of available technology, including nuclear power, renewables, cutting-edge energy storage systems, and hydrogen-powered solutions. For investors, we believe this transformation of the global power network presents powerful, long-term opportunities.

For additional insights, please view our full report, Charting Disruption: Outlook for 2026 and Beyond.