This piece is one in a series that delves further into the leading themes emerging from this year’s iteration of our flagship research project, Charting Disruption.

Critical minerals and materials are foundational to technological innovation and the economy of the future. AI data centers, renewable energy systems, electric vehicles, and defense tech are just some of the disruptive technologies that would not be possible without a broad range of materials, including copper, lithium, and rare earth elements. As a result, demand is expected to rise sharply over the coming decades, and supplies may not always be able to keep up.1 Meeting future demand while mitigating emerging risks from potential supply shortfalls will likely require significant investment in mineral production, processing, and battery technologies.2

Key Takeaways

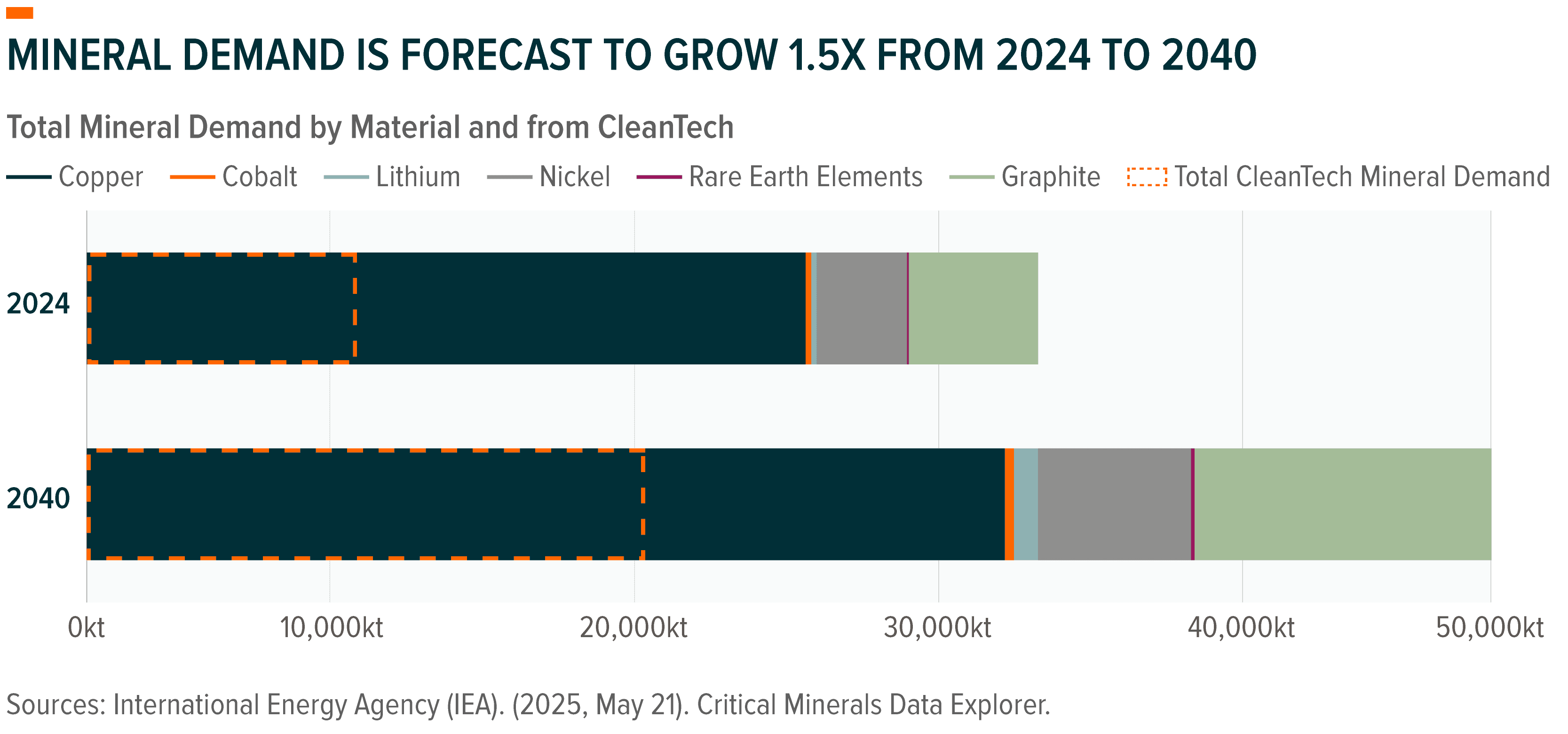

- Global critical mineral demand is forecast to grow 1.5x between 2024 and 2040 as mineral-intensive technologies and infrastructure – such as electric vehicles, renewables, and data centers – become more widely used.3

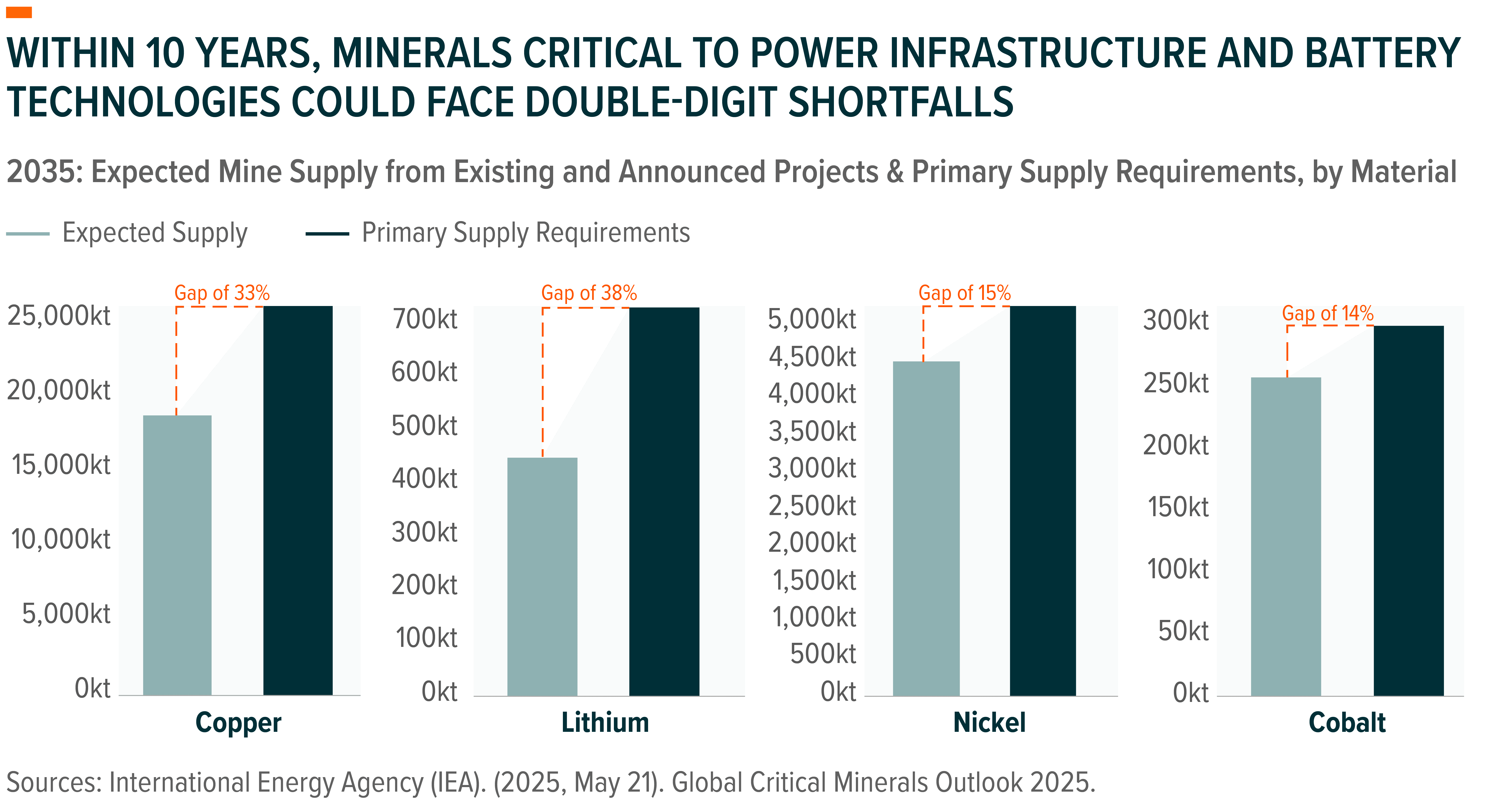

- Within 10 years, minerals essential to power infrastructure and disruptive technologies could face double-digit shortfalls.4

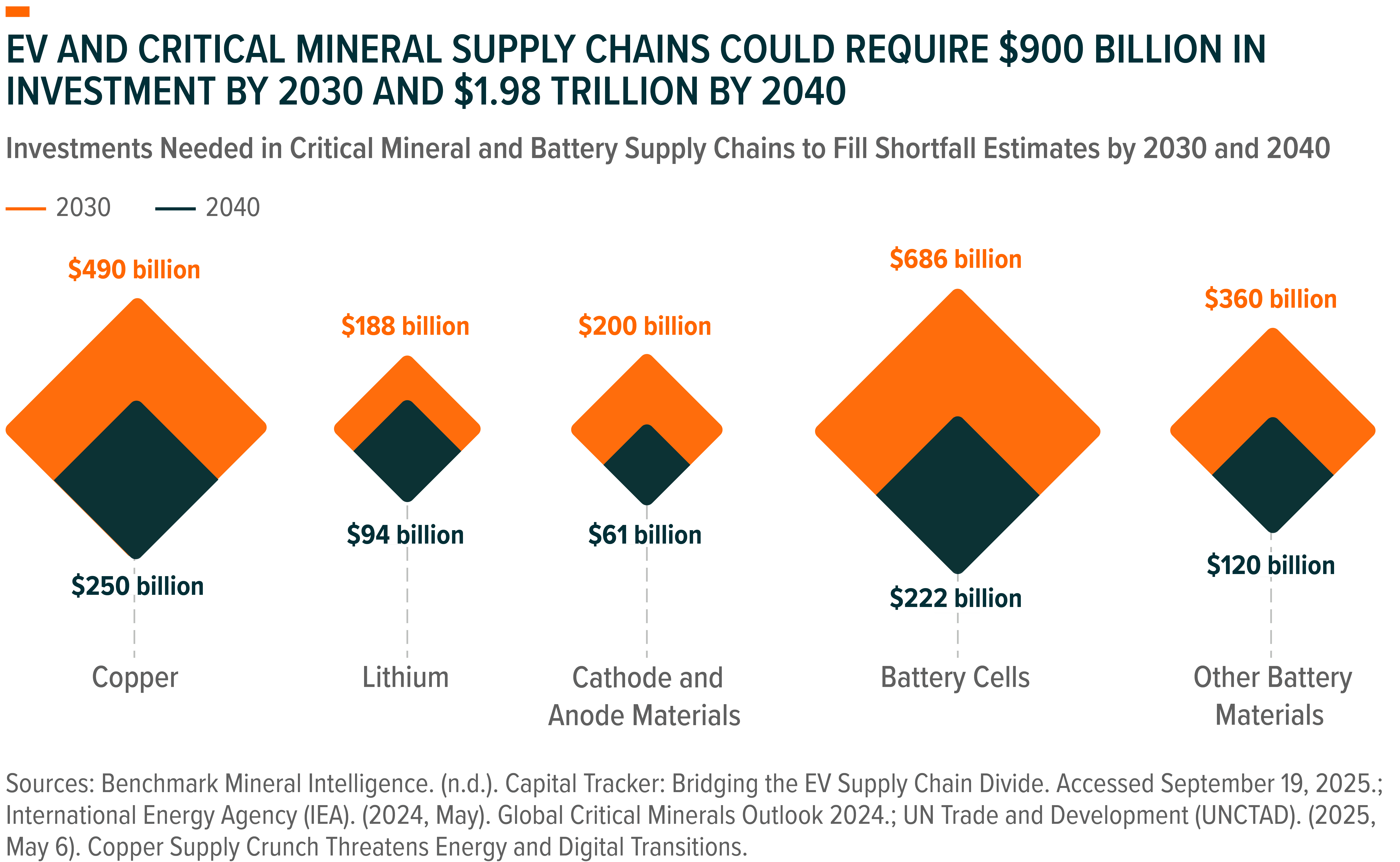

- Critical mineral supply chains could require nearly $2 trillion in investment through 2040 to mitigate supply risks and meet added demand.5

Technologies Powering AI and Electrification Depend on Critical Minerals

Power, transportation, data center, manufacturing, and defense industries are expected to drive the next wave of critical material demand due to the resource-intensive nature of many modern technologies. Total demand for copper, lithium, nickel, cobalt, graphite, rare earth elements (REEs), and other materials could rise 1.5x from 35,380 kilotons (kt) in 2024 to over 52,000kt in 2040.6

As cleaner power and transport technologies scale, cleantech’s share of total mineral demand is forecast to increase from 28% in 2024 to 41% in 2040.7 Electric vehicles (EVs) can require up to 6x more minerals than traditional internal engine vehicles, including 2.4x more copper per vehicle.8 Likewise, wind and solar power systems can be 6-13 times more mineral intensive than natural gas-fired power plants.9 Rare earth elements, for example, are an integral part of wind turbine motors but are not used in natural gas-fired power facilities.10

Beyond transportation and energy, battery energy storage systems are emerging as a key driver of mineral consumption, particularly for lithium, cobalt, nickel, and copper. While energy storage represented just 9% of lithium demand growth in 2024, it is expanding rapidly and could become a much larger demand source over the coming years.11 The power grid infrastructure needed to support these systems is also heavily dependent on conductive materials like copper.

Outside of cleantech, defense technologies – from drones to robotics – rely on REEs. Meanwhile, AI data centers are becoming a major consumer of minerals such as copper, aluminum, and REEs. Copper’s high conductivity makes it vital for networking, cooling, and power distribution systems. As AI workloads grow, data centers are poised to become one of the most mineral-intensive components of the digital economy.

Mineral Supplies May Fall Short as Electrification and AI Adoption Accelerate

Copper, lithium, nickel, and cobalt are among the materials potentially facing double-digit shortfalls by 2035, with copper and lithium most at risk.12 Shrinking development pipelines for new mines, lengthy project timelines, and highly concentrated supply chains are key factors creating long-term supply risks.

Historically, copper demand tracked the economic cycle. Looking forward, a shift towards more structural demand drivers such as electrification and AI data centers could lead to higher, more sustained demand levels. However, this rising demand comes at a time when copper supplies are dwindling. Based on a limited mining project pipeline due to declining ore grades and reserve depletion, global mined supply for copper could peak by the end of the decade.13 By 2035, there could be a 33% gap between global copper demand and available supply.14

Lithium faces longer-term supply risks due to a pullback in production and expansion plans from many major miners over the past several quarters. Forecasts suggest that annual lithium demand could increase from 1.2 million metric tons of lithium carbonate equivalent (MMt LCE) in 2024 to 2.5-3.3MMt LCE by 2030.15 This means that a lithium shortage could return by the start of the next decade, with a forecasted 38% supply-demand gap by 2035.16,17

Rare earth elements are relatively abundant compared to other minerals and metals, but they are at the center of the rising trade tensions between the United States and China. On October 9, 2025, China announced export controls on REE supplies and products containing magnets with even trace amounts of REEs.18 China is the dominant player throughout the supply chain, creating notable supply risks. According to Benchmark, China accounts for 69% of rare earth mining, 91% of refining, and 94% of rare earths magnet manufacturing.19

Meeting Higher Demand While Mitigating Supply Risks Could Require Trillions of Dollars20

Nearly $500 billion in investments could be required through 2030 to address potential shortfalls in just the lithium supply, battery materials, and batteries.21 To prevent shortages across the lithium battery value chain through 2040, total investment needs rise to an estimated $1.43 trillion.22 Meeting copper demand over the same period could require $490 billion.23

Given the strategic importance of many critical minerals, governments are ramping up efforts to encourage investment. In the United States, securing domestic critical minerals and materials supply has often garnered bipartisan support. In 2025, the Trump administration purchased equity stakes in Lithium Americas and MP Materials to help support domestic production of lithium and rare earth elements.24 Similarly, in early 2025, the European Union selected 47 projects that can boost the domestic production of critical minerals such as lithium, copper, cobalt, nickel, manganese, and REEs.25 The Critical Raw Material Act, which was passed in 2024, outlines a target for the EU to meet 25% of raw material demand from domestic activities by 2030.26

Conclusion: Electrifying and Digitizing the World Begins with Critical Minerals

As global economies adopt disruptive technologies at scale, demand for critical minerals is set to surge. Meeting this demand—and reducing supply chain vulnerabilities—will require sustained investment across the value chain, from exploration and processing to battery innovation. For investors, we believe exposure to this structural trend is key to capturing the long-term growth of the building blocks that shape the modern economy.

For additional insights, please view our full report, Charting Disruption: Outlook for 2026 and Beyond.