This piece is one in a series that delves further into the leading themes emerging from this year’s iteration of our flagship research project, Charting Disruption.

Biotechnology stands at the forefront of medical innovation, transforming once-intractable conditions into treatable and, in some cases, curable diseases. Fueled by breakthroughs in artificial intelligence (AI), genomic science, and precision medicine, the sector is reshaping how therapies are discovered, developed, and delivered. With pharmaceutical R&D spending expected to reach $360 billion by 2030 – up roughly 17% from today – companies are channeling investment toward platforms that can produce more targeted, durable, and efficient treatments.1

This shift reflects a growing understanding of disease at the molecular and genetic levels. New therapeutic modalities – from gene and cell therapies to GLP-1s – target the biological root causes of illness rather than merely managing symptoms. As a result, biotechnology’s role in the global healthcare landscape is expanding from experimental frontier to structural growth driver, with meaningful implications for patients, providers, and investors alike.

Key Takeaways

- The biotechnology market is entering a new growth phase, driven by the convergence of genomic science, artificial intelligence, and precision medicine, as global R&D investment approaches $360 billion by 2030.2

- Breakthrough therapeutic platforms are expanding access and efficiency, from GLP-1s reshaping chronic disease treatment to genomic medicines moving from rare disorders to broader clinical adoption.

- Biotechnology represents a long-term structural growth theme, aligning with global trends in aging, healthcare modernization, and technological innovation that continue to drive demand for advanced therapies.

Therapeutic Opportunity: A Turning Point in Innovation

Pharmaceutical innovation is entering a new phase defined by precision and scalability. Regulators are increasingly approving biologics, gene therapies, and cell-based treatments that target diseases more effectively and offer the potential for lasting remission. Meanwhile, AI and advanced modeling are improving trial design and predictive accuracy, reducing costs and timelines throughout the development cycle.

Yet success is not evenly distributed across the therapeutic landscape. Risk and reward vary widely by specialty – a reflection of differing biological complexity, patient population size, and commercial potential.

As seen in the chart above, areas such as cardiovascular disease, dermatology, and neurology are, on average, expected to have higher success rates of drug approvals with meaningful market potential. In contrast, treatments for oncology and hematology face higher chances of not gaining approval, but continue to command premium investment due to persistent unmet need.

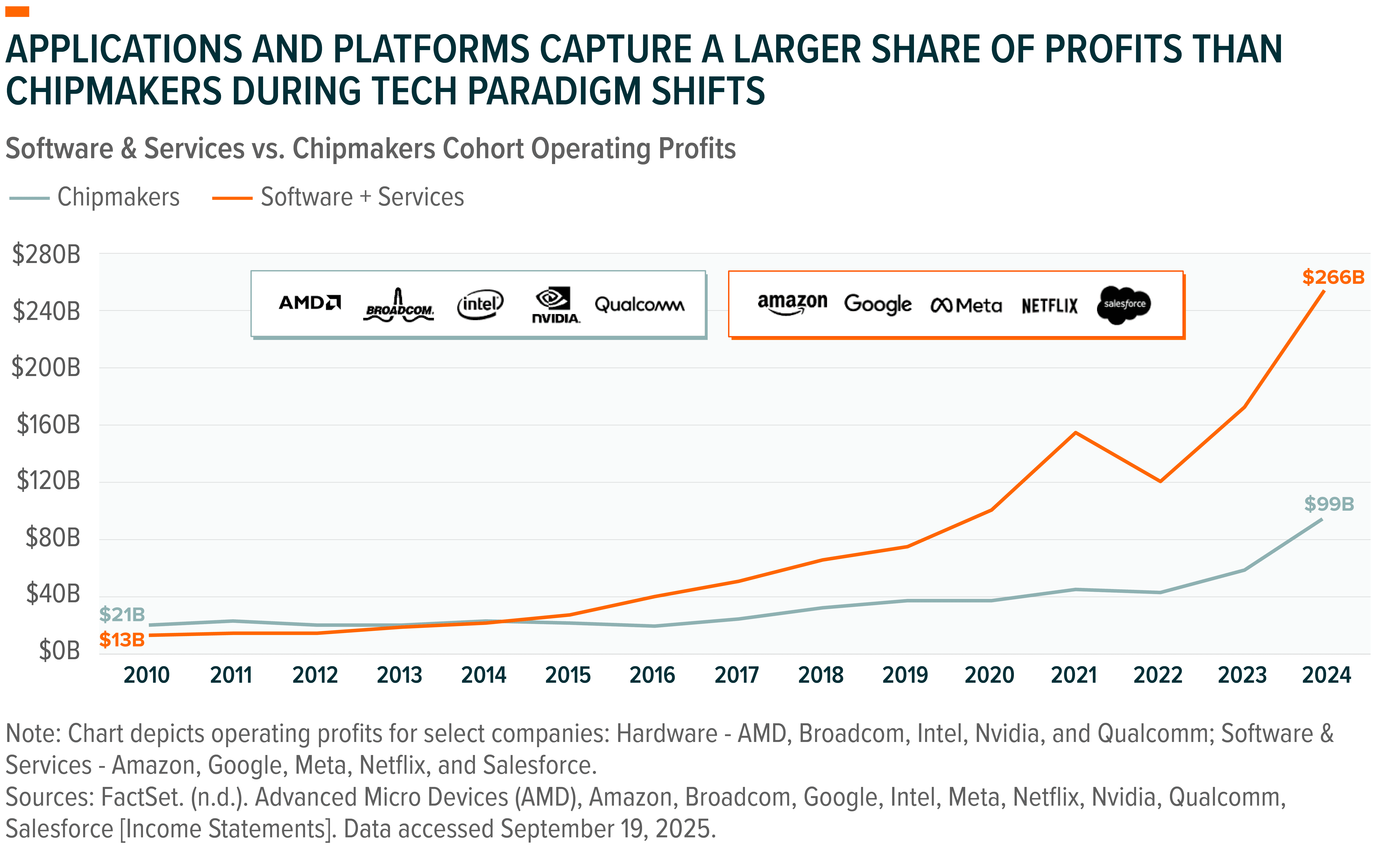

This distribution of opportunity underscores a fundamental trend: innovation is shifting from singular breakthroughs to adaptable platforms. Technologies such as gene editing, mRNA, and antibody conjugates can now be tailored across multiple conditions, improving scalability and diversifying risk. Platform-based R&D not only accelerates discovery but also makes drug development more modular, enabling firms to expand pipelines leveraging existing scientific and distribution infrastructure.

Pharmaceutical R&D has become an exercise in precision – identifying high-impact targets where scientific readiness, patient demand, and financial viability converge. As capital allocation tightens, success will hinge on data-driven insights and the ability to align innovation with the greatest areas of clinical and commercial opportunity.

GLP-1 Therapies: Expanding Beyond Metabolic Disease

Once limited to diabetes and obesity management, GLP-1 receptor agonists are evolving into one of biotechnology’s most versatile and transformative categories. Their mechanism of action – which regulates appetite, metabolism, and inflammation – allows for applications that extend well beyond metabolic disease.

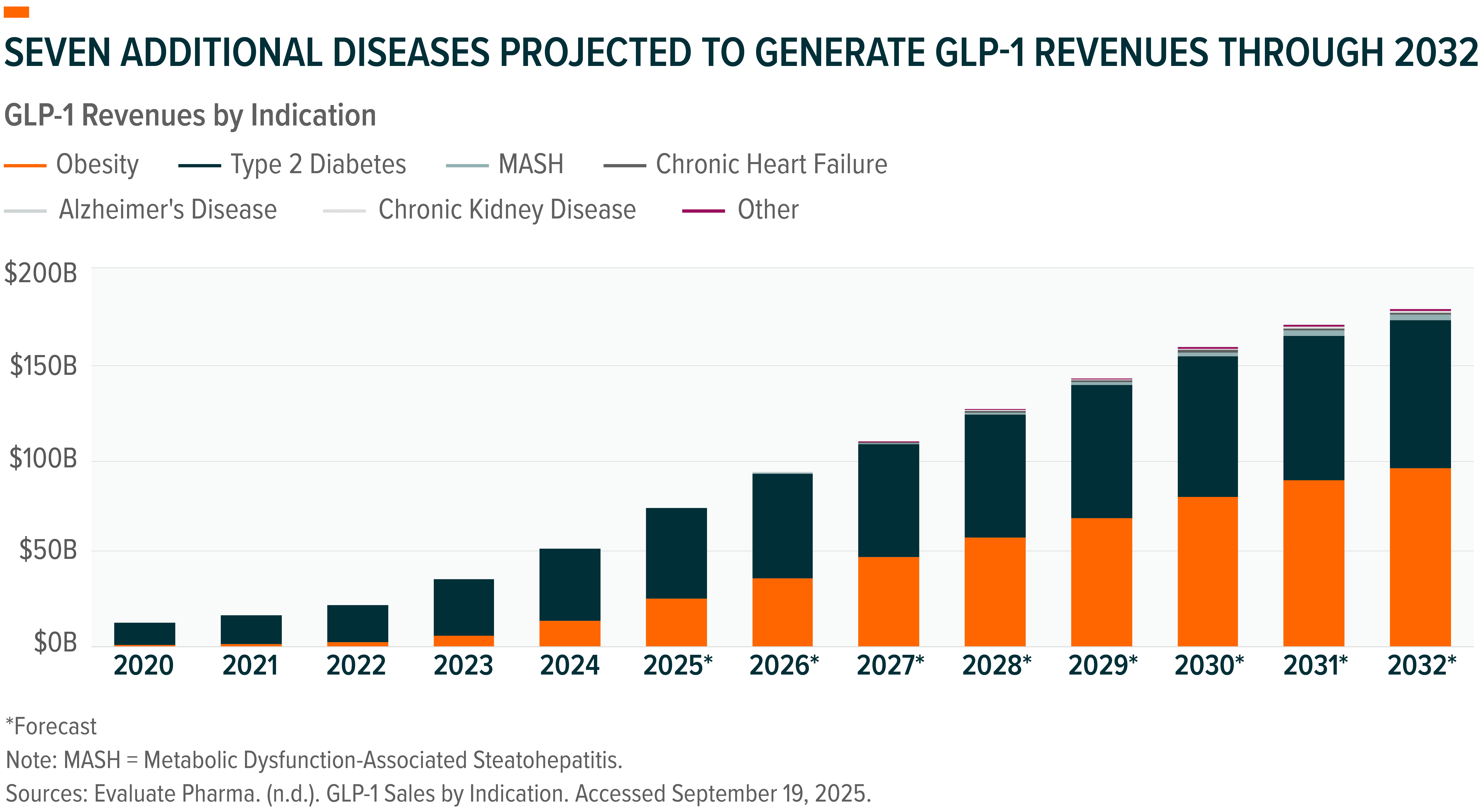

Between 2020 and 2032, GLP-1 revenues are projected to expand nearly tenfold, reaching $183 billion, driven by seven new indications beyond Type 2 diabetes and obesity, including chronic kidney disease, cardiovascular disorders, and Alzheimer’s disease.3

More than a dozen GLP-1 drugs are currently approved, and over 25 new compounds could enter the market by 2032, a pipeline breadth reflecting growing clinical validation and commercial confidence.4 The ability to address multiple chronic diseases through a single therapeutic pathway demonstrates how biotechnology’s value is increasingly tied to convergence, where one innovation generates cascading benefits across multiple medical specialties.

Genomic Medicines: Scaling from Proof of Concept to Practice

Once a high-risk research field, genomic medicine is maturing into a commercially viable cornerstone of healthcare. Encompassing gene therapy, cell therapy, gene-modified cell therapy, and gene editing, the field is expected to generate nearly $80 billion in annual revenue by 2032, or about 5% of total pharmaceutical sales.5

That growth – a forecasted 32% compound annual rate – reflects rising confidence as safety improves, manufacturing scales, and regulatory approvals accelerate.6 In recent years, the FDA has approved a record number of gene and cell therapies, validating the technology’s clinical effectiveness and expanding its application to broader patient populations.7

These breakthroughs are enabling medicine to move beyond symptom management toward true disease modification. Therapies can now target genetic defects at their source, offering the possibility of one-time treatments for conditions that were once chronic or fatal. As production costs decline and delivery mechanisms become more refined, genomic platforms are also being explored for widespread diseases such as cardiovascular and metabolic disorders.

Rather than a niche category, genomic medicine is fast becoming a key to next-generation care – a potential solution allowing for personalized treatment and improving long-term outcomes across the healthcare system.

Conclusion: The Future of Medicine

Biotechnology is transitioning from discovery to deployment. What was once experimental science is now a critical driver of global healthcare, defined by its ability to turn biological insight into scalable solutions. As artificial intelligence, genomic science, and data analytics converge, the industry is moving toward faster, more precise, and more personalized medicine.

GLP-1 therapies are expanding the boundaries of chronic disease management. Genomic medicines are progressing from niche applications to broader clinical practice. And platform-based innovation is enabling companies to adapt discoveries across multiple conditions, compounding both medical and operational efficiency.

As these breakthroughs move from research to real-world application, they are poised to create powerful tailwinds for investors seeking exposure to next-generation healthcare solutions. Biotechnology represents a long-term structural growth theme – one positioned at the intersection of aging demographics, technological advancement, and healthcare modernization – with innovation serving as both catalyst and compass for future opportunity.

For additional insights, please view our full report, Charting Disruption: Outlook for 2026 and Beyond.